If you want to fill a financing pit involving the college or university will set you back as well as your federal aid, then individual college loans could be the best provider. However, with the essentially high interest rates and you will shortage of borrower defenses, it constantly is sensible to deplete government student loan possibilities before turning to personal lenders. In order to be considered, a borrower have to be a good U.S. resident and other qualified status and you can satisfy financial underwriting requirements. The newest debtor must see applicable underwriting requirements according to certain financial requirements. Splash doesn’t make certain that you are going to receive any mortgage offers otherwise that your application for the loan would be recognized. If the acknowledged, their genuine speed was within this various cost and you can is dependent upon a variety of things, and label away from financing, a responsible credit history, income and other points.

Pay check loan providers and money advance apps play with a few secret bits of information to accept you to own a pay day loan online otherwise a cash loan. Life salary so you can income is difficult sufficient as opposed to pricey issues developing. If you’ve sick all other borrowing possibilities, the final resort will be a payday advance loan or payday payday loan.

Simply how much tend to a great $20,one hundred thousand mortgage costs?

Once you’re prequalified with loan providers, compare consumer loan rates and you can charges for the best render. As an example, unsecured loan term lengths generally vary from step one to help you 7 ages, even though it may differ by lender. Consider carefully your fees function and the time needed to pay off the mortgage to thin your search. Some of the mastercard also provides that seem on this website come from creditors at which we discover monetary compensation. So it payment could possibly get feeling how and you will where things appear on which webpages (along with, such as, your order in which they look).

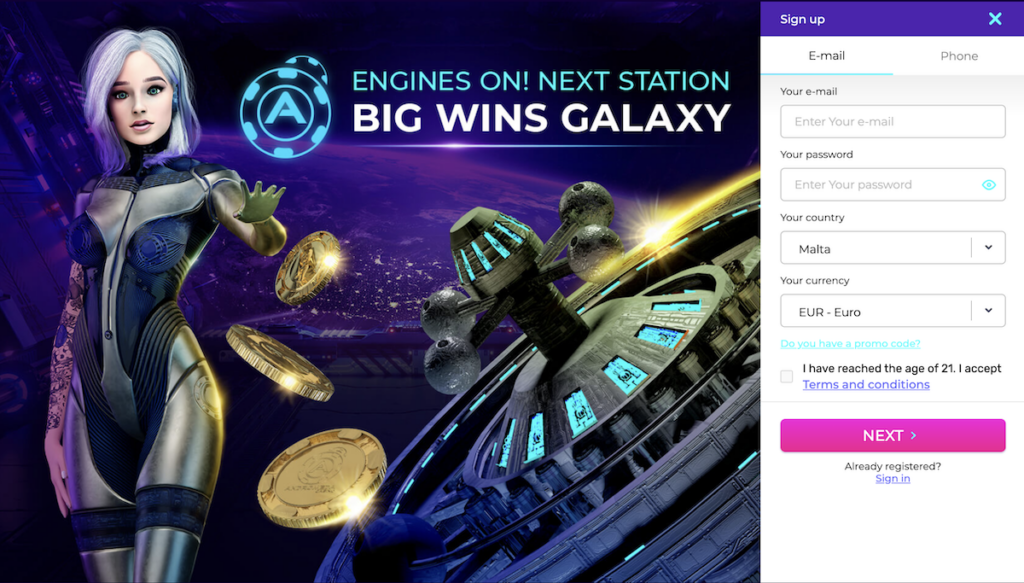

Learn more about bonuses provided by CashSplash Gambling establishment

Personal loans are cost fund that give you with a swelling sum of money, generally within this days of applying (certain loan providers provide exact same-day unsecured loans). More often than not it’re also unsecured, however lenders manage provide guarantee money, and therefore cover your pledging a secured asset to hold the mortgage. You’ll have a tendency to should make which commission while the a lump sum otherwise, at the most, over the course of one year.

Within the Cash Splash, the brand new progressive jackpot is brought on by getting 5 nuts signs (Dollars Splash signal) to your 15th payline of your own games. It combination of profits and you may antique icons makes Bucks Splash a good eternal position to have people looking for both regular gains and a great test at the jackpot. The brand new symbols to your reels realize a vintage video slot design, but every one possesses its own novel commission potential.

Your loan provider is generally prepared to accept money one waives most of the fees and penalties and you will costs, leaving you along with your simple interest and you may fees to spend. You’ll also need to features some other student loan in order to combine your defaulted financing. If your defaulted education loan is the just one you have, you acquired’t qualify for an integration financing. Your government Lead Consolidation Loan can get mortgage you to’s on average their previous financing.

Your secure financing which have equity, which could and help you be considered otherwise https://mrbetlogin.com/bonus-poker-50-hand/ decrease your price. Refinancing or consolidating individual and you can government student education loans might not be the right decision for all. Prior to getting a private education loan as a result of Splash, you should opinion all of your options.

Prequalification is not a deal away from credit, as well as your final speed may vary. Just be prepared to waiting a few days to find your finances, while the money may take 3 to 5 months immediately after recognized. Happy Currency provides an a+ get on the Bbb which is perfect for debt consolidating and charge card consolidation financing. This guide explores just what qualifies as the an exclusive student loan, exactly how private college loans functions, and if to look at it financing kind of.

Which put added bonus away from CashSplash Casino provides a betting requirement of 40-minutes the worth of your own extra. So that you can withdraw the earnings, you ought to bet at the least so it quantity of money. As an example, if one makes a real money put well worth €a hundred, you are going to discovered a complement added bonus of €150.

If you are individual student loan rates of interest are usually greater than the individuals out of government student loans, you can qualify for lower prices for those who have excellent borrowing from the bank. Individual college loans do not have the based-inside borrower protections from government college loans. As well, to own individuals as opposed to expert borrowing, individual college loans are apt to have highest interest rates than simply federal figuratively speaking, which results in a top total cost of borrowing from the bank.

- You can also be eligible for government has, for instance the Pell Offer, if you are an enthusiastic undergraduate pupil with exceptional financial you want.

- We’lso are transparent about how precisely we could render quality content, competitive costs, and helpful devices to you by describing the way we return.

- Payday loans and you can credit card dollars professionals are two sort of high-desire financial obligation to stop.

- Do that for the record code that has been sent to you because of the email on your own shipping confirmation and you can birth guidance out of Splash trends on the web.

While not all lenders stretch money to consumers which have poor credit, people who perform makes it more convenient for consumers to help you become approved because of the provided points past a credit rating. Twenty-seasons mortgage loans usually have straight down rates than just 29-season money. A $325,one hundred thousand home loan at the six.25% might have a payment per month out of $2,376. The brand new expanded the mortgage identity, the greater amount of your own interest rate affects the payment count. A good $300,100000 mortgage that have a great six.5% home loan rate will have a cost from $1,896. A speed loss of 0.fifty payment items, so you can six%, reduces the payment in order to $1,799.

So you can be eligible for federal figuratively speaking, you’ll need to finish the Free App for Government Scholar Assistance (FAFSA). This form find the qualification not simply to have student education loans but but in addition for gives, grants, plus the federal works-investigation program. From the contributing over the mandatory payment per month, you can reduce your loan equilibrium smaller and spend smaller focus more day. Consider placing any unexpected fund — such as income tax refunds, bonuses, or monetary gift ideas — on the your own student loan balance. Should you decide to pay off the college loans very early, a benefits statement is very important. It offers an obvious and exact amount needed to completely settle the debt, as well as desire and any charges.

That’s best depends on what you are able qualify for, the expense of the appliance, in which you order it, and also the monthly payment you really can afford. Normally, these types of prices is actually below those people available due to private figuratively speaking. Refinancing is additionally an option to get rid of monthly premiums and you can overall credit costs when you can decrease your interest. Yet not, extremely individuals which have federal money, as well as Head Money and you may FFEL system finance, should not refinance, while the doing this setting giving up government financing advantages. You will find four income-driven payment (IDR) plans open to Direct Mortgage borrowers.

On the other hand, less credit history can get improve your costs since the lenders discover your much more attending standard on the education loan financial obligation. While you are direct conditions are different because of the system, people options will help repay one another federal and personal student education loans. Observe just what’s found in your area, see your state’s Service from Training site or consult with your elite group organization. People that lent away from Sallie Mae after this 2014 split provides individual student education loans, and this aren’t eligible for federal forgiveness programs. However, Sallie Mae have a tendency to launch debts for consumers who pass away or getting totally and you can forever handicapped. Generally, the brand new founded-inside debtor protections from federal figuratively speaking make them a far more attractive choice.